Kadey B.J. Schultz

ABOUT

CASES

COMMUNITY INVOLVEMENT

PUBLICATIONS

ENGAGEMENTS

BLOG

Since articling in 1999 with a national insurer, my practice has focused on insurance defence litigation, anti-fraud investigations, and coverage disputes. I have significant arbitration, trial and appeal experience before the Superior Court, Divisional Court, Court of Appeal and Supreme Court of Canada, as well as FSCO, the LAT and WSIAT. I am your strategic business partner, combining big picture thinking with refined technical skills: delivering exceptional service and advice... and I love what I do.

My practice focuses on anti-fraud in the insurance space, together with accident benefits claims, tort defence, property disputes, coverage disputes, loss transfer and priority matters. I defend and prosecute against opportunistic and organized auto, property, life and health fraud.

I have been honoured with peer and industry acknowledgements, including the Lexpert Zenith Mid-Career Excellence Award, the Lexpert Rising Stars, Leading Lawyers under 40 Award, the Lexpert US/Canada Litigators to Watch, as well as the Canadian Defence Lawyers’ Exceptional Young Lawyer Award. I’ve been ranked as a Best Lawyer in Canada for Insurance Law since 2019.

In addition to my practice, I have been an adjunct professor at the University of Windsor Faculty of Law, teaching the Lawyer as Conflict Resolver, the Professional Identity and Legal Skills (PILS) and the Business of Law courses. I have also been Guest Faculty with the Education and Development Bureau of the OPP, The Ontario Police College and the Toronto Police Services. From 2002-2005 I was a professor with Brock University, having designed and taught the first Conflict Management in Policing university course in Canada with the Criminal Justice and Policing Bachelor of Arts program.

I am also a committed contributor to the insurance industry, having published and lectured extensively with numerous organizations such as the Ontario and Canadian Insurance Adjusters' Associations, the Insurance Institute, the Canadian Defence Lawyers Association, RIMS Canada, the Ontario Bar Association and Osgoode Hall's Professional Development Programme. I worked closely with the Medical-Legal Society of Toronto serving in my last capacity as the 1st Vice President.

Volunteering is a very important part of my life. I am a member of the WICC Gala Committee and volunteer/fundraise with several charities. My primary fundraising focus is with Holland Bloorview Kids Rehab Hospital, working to raise funds for the Biggar Endowment in an effort to change the world for kids with Duchenne Muscular Dystrophy. I serve on the Board of Directors with the Holland Bloorview Kids Rehabilitation Hospital Foundation.

As a lawyer, mother, mentor, educator and thought leader, it is a privilege to be so engaged in my community and industry.

WORK EXPERIENCE

Partner, Schultz Law Group LLP, Toronto (2015 - present)

Adjunct Professor, University of Windsor, Faculty of Law (2014 - 2020)

Partner, Hughes Amys LLP, Toronto (July 2009 - August 2015)

Associate, Dutton Brock LLP, Toronto (December 2000 - July 2009)

Mediator, Trainer and Consultant, Toronto (June 1998 - 2010)

Sessional Professor, Brock University, St. Catharines (Aug. 2002 - Jan. 2005)

Student-at-law, Royal & SunAlliance, Toronto (July 1999 - June 2000)

EDUCATION

Year of call: 2001

Certified Risk Manager, Canadian Risk Management & GRMI designation, University of Toronto (2018)

Master of Laws LL.M., Osgoode Hall Law School (2003)

Bachelor of Laws LL.B., University of Windsor, Faculty of Law (1999)

Bachelor of Arts B.A., (Political Science and Theater & Performance) McGill University (1996)

AWARDS

Recognized as a Best Lawyer in Canada in Insurance Law, by Best Lawyers (2019 - 2023)

Winner, Lexpert Zenith Mid-Career Excellence Award (2018)

Winner, Lexpert Rising Stars, Leading Lawyers under 40 in Canada (2015)

Finalist for Lexpert's Rising Stars Top 40 under 40 (2014)

Exceptional Young Lawyer Award, Canadian Defence Lawyers Association (2010)

Dorothy Waddicor Award in Alternative Dispute Resolution, University of Windsor, Faculty of Law (1999)

John W. Whiteside Award for Contribution to the Faculty of Law, the Community and the Legal Profession, University of Windsor, Faculty of Law (1999)

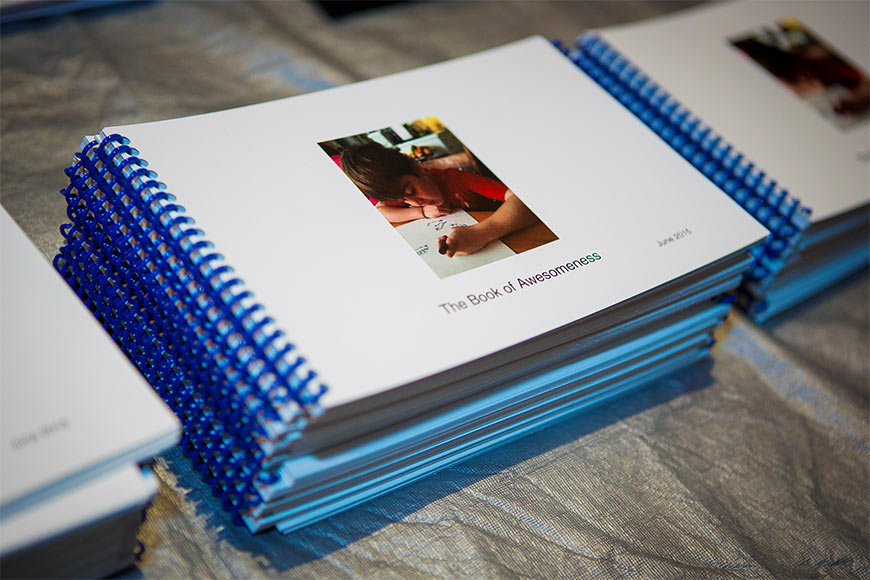

Over the last decade, Kadey has participated in a variety of fundraising activities, including an annual event called Music Heals at the Toronto Hard Rock Café that has helped raise over $295,000.

"As a mother with a son who suffers from Duchenne Muscular Dystrophy, generating awareness and raising funds to support the quality of life of kids with DMD is part of what I do every day."

See highlights

See highlights

See highlights

The inaugural Music Heals event took place in 2012, in support of Kadey Schultz and her son Emery, now eight, who was diagnosed with Duchenne Muscular Dystrophy (DMD). Funds raised benefit the Biggar Endowment at Holland Bloorview Kids Rehabilitation Hospital.

In 2015, Kadey announced her goal of raising $1,000,000 for the Biggar Endowment for Muscular Dystrophy by the time Emery is 18. In 2012, $20,000 was raised at this event and, in 2013, the number jumped to $38,000. In 2014, it increased again to $45,000, but it didn’t stop there. Music Heals ignited a fundraising challenge, which raised $100,000 by November 1, 2014. As a result, a private donor contributed a further $75,000 to the Biggar Endowment. Through Music Heals and everyone’s efforts, the Biggar Endowment has now received over $233,000 since Emery’s diagnosis.

See highlights

Mobilizing For A Cure

Since the inception of WICC in 1996, with the help of the entire insurance industry and its supporters, over $11,000,000 has been raised in support of cancer research and education. This has been achieved from industry support at a variety of WICC functions, including dinners, learning breakfasts, concerts, relays, golf tournaments, as well as the purchase of WICC candles, CDs and other products. In addition, numerous individuals, companies and associations within and related to the insurance industry have held or sponsored events specifically to raise funds for WICC or directed the proceeds of their annual events to WICC.

The involvement of all WICC supporters and volunteers has made it possible for WICC to achieve its Mission: To mobilize the Canadian Insurance Industry in the fight against cancer by focusing on cancer research, support and education.

See highlights

| Past Events | Date | City |

|---|

| Loss Transfer/Priority Disputes | 2024-03-07 | Toronto | ||

Loss Transfer and Priority Disputes are unique disputes that arise between insurance companies with respect to statutory accident benefit payments. This program is targeted for AB practitioners, lawyers and claims professionals alike, to refresh and update their knowledge and skills while learning from those who work in this complex area of the law. | ||||

| Costs: What You Need to Know | 2024-02-09 | Toronto | ||

| Defending Accident Benefits Claims: A Crash Course | 2023-06-09 | Toronto | ||

| ||||

| Creating a Comprehensive Strategy to Advance Toward Settlement | 2023-05-31 | Toronto | ||

When negotiating settlements, it is critical that you have an all-encompassing plan for how best to move towards settlement discussions. You will need to consider how each side wants the file to settle, the differences in how the parties analyze the file, and how both want resolution to occur before you choose an approach. Discover how to determine the best strategy and how to:

| ||||

| Durham Law Association - 5 Ways to Keep a Work/Life Balance | 2022-10-14 | Ajax | ||

As part of the Durham Law Association Civil Litigation Conference 2022, Kadey B.J. Schultz presented: 5 Ways to Keep a Work/Life Balance. | ||||

| RIMS Canada: The Impact of Rising U.S. Loss Costs, Social Inflation and Third-Party Litigation Funding | 2022-09-12 | Halifax | ||

Kadey Schultz will provide insight into the changing claims landscape in Canada, and the key differences between the U.S. and Canada from a litigation and social inflation perspective, including relevant case law and the emergence of TPFL in Canada. Kadey will cover off the differences between Canada and U.S. court systems, the impact that U.S. court decisions and social inflation have on the Canadian landscape, and TPFL funding in Canada. The risk manager will discuss the risks that we should be aware of, and risk mitigation strategies to employ to help reduce your exposure to risk through education, mitigation and advocacy, along with a regular review of your risk selections from a financial perspective. | ||||

| Osgoode Certificate in Motor Vehicle Accident Law and Practice: Principles of First-Party Insurance and the Duty of Utmost Good Faith | 2022-04-12 | Toronto | ||

| Insurance Institute of Canada: Fireside Chat - Put Your Oxygen Mask On First | 2022-03-24 | Toronto | ||

Join our Fireside Chat to discuss the impact of the pandemic on our systems and structures as we "re-integrate" and what does that even mean? From business development, IT infrastructure, HR, claims management, court, and tribunal processes/resources – what does the future look like? Your chapter has lined up an amazing group of industry professionals for a panel discussion on thriving after Covid shattered the traditional workplace. Join us to learn how to embrace the mindset of flexibility in this ever-changing world. Moderator: Kadey Schultz, Partner, LL.B., LLM, Schultz Frost, LLP Guest Panelists: Sheldon Williams, Chair and Co-founder, Canadian Association of Black Insurance Professionals Heather Matthews, Chief Client Officer, Crawford & Company (Canada) Inc. Jeremy Abellera, Vice President, Business Integrations, Disaster Rx Deborah Upton, Vice President, Pricing, Gore Mutual | ||||

| Insurance Institute Virtual Symposium West - Social Inflation: The biggest emerging risk you need to know about | 2021-08-12 | Toronto | ||

Social Inflation: The biggest emerging risk you need to know about “Social Inflation” describes the trend of rising insurance costs due to increased litigation, plaintiff-friendly judgments, and higher jury awards. Traditionally, the Canadian insurance industry has been more sheltered, ‘peering over the fence’ in amazement at U.S. counterparts dealing with heavy-hitting litigation awards and the general inclination toward legal action. But times are changing and our shelter is under theat. If litigation costs in Canada are creeping up, what are the causes, what does this mean for the industry, and what should insurance professionals be considering now to succeed in the future? Join our panel – bringing knowledge and expertise from the legal, claims, and broker perspectives – providing the very latest updates on the social inflation trend, and just how concerned stakeholders in the insurance industry should be. And as we grow our understanding of the issue, the panel will guide us through which industry segments will be most affected, as well as discussing potential risk mitigation strategies, in order to prepare for a more litigious future. | ||||

| Law Society of Ontario: 15th Solo and Small Firm Conference | 2021-06-10 | Toronto | ||

Breakout Two (11:25 am - 12:15 pm) - Planning for Absences from Your Practice At some point in your legal career, you may want or need to take time away from your practice. Whether for parental or mental health leave, illness or medical leave, or to be a caregiver for others, the need to step away from law can be expected (or unexpected). There are steps that you can – and should – take to prepare for this type of situation. Find out how you can use appropriate systems when the need for a leave arises. Hear about how you can reduce the risk and anxiety that may come with taking an extended leave from practice. Hear what our speakers have done to keep their practices going when they were faced with these challenges themselves.

Moderator: The Honourable Kathleen Erin Cullin, Superior Court of Justice Panelists: Kadey Schultz, Schultz Frost LLP Jennifer Mathers McHenry, Mathers McHenry & Co.

| ||||

| Unconscious Bias in the Medical and Legal Professions | 2020-10-07 | Toronto | ||

Join the Medico-Legal Society of Toronto for a robust skill-building session and panel discussion moderated by Kadey B.J. Schultz: | ||||

| Virtual ORIMS | 2020-10-06 | Toronto | ||

HOW ARE WE DOING? A Glance Into How Service Providers Are Meeting Service Challenges Under COVID Conditions Panel: Kadey Schultz, Schultz Frost LLP; Jeff Reitsma 30 Forensic Engineering; and Michael Alwin, Sedgwick Moderator: Ginette Demers, Director, Domtar | ||||

| Insurance Institute of Ontario: Fireside Chat | 2020-04-28 | Hamilton | ||

Insurance Institute of Ontario: Fireside Chat Moderated by Kadey Schultz Whether you're an organizational leader or rising insurance professional, you'll gain a deeper awareness and appreciation for key issues impacting your organization, including:

Michaelangelo’s Banquet Hall, Hamilton

| ||||

| 3rd Motor Vehicle Litigation Summit | 2020-04-02 | Toronto | ||

Practitioners who do motor vehicle litigation work need one program where they can receive a comprehensive review of all things relevant to their practice. This summit has become that core program for many. Turn to these experienced presenters for an update on LAT procedures, causation, the impact of cannabis legalization, plus much more. It's time well spent. Cannabis: Damages Issues • Medical v. Recreational Moderator: Jennifer Hoffman Panellists: Tanya Harris & Kadey Schultz Donald Lamont Learning Centre, 130 Queen Street West, Toronto 11:30 am – 12:00 pm

| ||||

| Osgoode Professional Development: Expert Evidence In Personal Injury Cases 2020 | 2020-03-04 | Toronto | ||

Expert Evidence and Future Care Reports: Valuable Tool Or Irritant? 11:35 a.m. – 12:15 p.m. Osgoode Professional Development Centre,

| ||||

| A Couple Years in: Has #MeToo Changed how we do Business? | 2020-02-27 | Kitchener-Waterloo | ||

Hosted by the OIAA: Kitchener-Waterloo A Couple Years in: Has #MeToo Changed how we do Business?

Golf’s Steakhouse, 598 Lancaster Street West, Kitchener, ON | ||||

| OIAA Holiday Party | 2019-12-11 | Toronto | ||

| 2019 Unconscious Bias Conference | 2019-11-12 | Toronto | ||

Join Insurance and Legal industry leaders at the highly anticipated 2019 Unconscious Bias Conference and immerse yourself in a thought-provoking curriculum which was designed to provide delegates with the following key take-aways to bring back to their respective organizations:

November 12th, 2019 | The Advocates’ Society | Toronto 250 Yonge Street, Suite 2700, Toronto, ON

This program contains 6 hours of EDI Professionalism Content as approved by the Law Society of Ontario. | ||||

| Medico-Legal Society of Toronto: Brain Injury - Diagnosis, Treatment, Litigation | 2019-10-24 | Toronto | ||

| CIP Society 2019 Symposium West | 2019-08-22 | Cambridge | ||

Designed by insurance professionals for insurance professionals, CIP Society Symposium West is a full day of progressive learning aimed at increasing your skills and knowledge level. Now in it's fourth year, the event provides a full day of professional and leadership development alongside multiple networking opportunities with insurance and business leaders. Symposium West is held for insurance professionals in the Southwestern Ontario, Hamilton/Niagara and Conestoga chapter areas. It brings together bright minds to give talks that a idea-focused and on a wide range of subjects, to foster learning, inspiration and wonder – and provoke conversations that matter. The event features: • Inspiring keynote speakers

UP CLOSE AND PERSONAL: SENIOR LEADERSHIP PANEL Join these senior industry leaders 'Up Close and Personal': Steve Smith | President & CEO, Farm Mutual RE Moderator: Kadey Schultz - Partner, Schultz Frost LLP

https://www.insuranceinstitute.ca/en/institutes-and-chapters/Ontario/Symposium-West | ||||

| University of Windsor - The Business of Law | 2019-06-23 | Windsor | ||

A special thank you to the following professionals for making The Business of Law: Start as you Plan to Continue, such a success! | ||||

| Music Heals 2019 | 2019-06-20 | Toronto | ||

| RIMS 2019 - Cyber Resilience with Social Media and Digital DNA: Managing Risk from the Inside Out | 2019-04-30 | Boston | ||

Cyber Resilience with Social Media and Digital DNA: Managing Risk from the Inside Out Kadey Schultz, Schultz Frost LLP Keith Elliott, Reed Research Inc. As you experience a live hack and the investigation debriefing, get to know the cyber risks as well as the risk management resources available to you through skilled use of social media and digital DNA. Better understand social media, its relation to cyber crime and internet-based claims issues. Reconsider your social media and anti-fraud strategies from technical, investigative and litigation perspectives. Prepare to reduce risk from inside users, guide investigations and manage claims. Learning Objectives: - Link a concrete, adaptive and consistently applied social media policy to its value in reduced risk

Boston Convention & Exhibition Center April 30, 2019, 11:00 am

| ||||

| Excellence and #MeToo: What to Learn and What to Do? | 2019-04-11 | Toronto | ||

| The Impact of Concussions on Children and Adolescents | 2019-02-05 | Toronto | ||

Over the last few years, increased focus on the effects of concussion and brain injury have led to new assessment technologies as well as improved treatment and management approaches. Join us to hear Canada’s leading experts in this developing field for a discussion of today’s art, science and law. Co-chaired by Kadey Schultz, Schultz Frost LLP and Dr. David Corey, Brain Scan Inc. Featuring Dr. Nick Reed, Head of Concussion Program, Holland Bloorview Kids Rehabilitation Hospital “Concussion and Neuroimaging: Making the Invisible – Visible” Dr. Alain Ptito, Senior Neuroscientist, McGill University “Managing Concussion from a Legal Perspective” Alison Burrison, Burrison Law Vantage Venues 150 King Street West, 27th Floor Toronto 5:00 to 8:00 pm

| ||||

| CyberSleuths | 2018-11-21 | Toronto | ||

Join us for lunch with leaders in the industry! Wednesday November 21, 2018, 12:00 pm to 4:30 pm Above E11even, Meeting Room 15 York Street, Toronto If you are: a) an insurance adjuster or manager who uses Social Media and Internet Investigations as part of your claims b) an adjuster handling Cyber Risk or Cyber Crime matters; c) a professional who wants to enhance your ability to access digital DNA; or d) a broker with interest in fraud, misrepresented claims and Cyber Risk, then this is the seminar for you! Enhance your understanding of where we are today in this ever-evolving field. Gain insights into what tools are Not yet invited? Please contact John.Good@ReedResearch.com by Wednesday November 7, 2018. | ||||

| CDL Accident Benefits Fall Classic | 2018-11-01 | Toronto | ||

Kadey Schultz presents "Best Practices for Efficient Use of the LAT" with Cecil Jaipaul and Jasmine Daya at the 2018 CDL Fall Classic.

| ||||

| RIMS Canada - CyberSleuth | 2018-09-24 | St. John's | ||

St. John's Convention Center, 3:00 pm For risk managers and other insurance professionals who want to enhance their ability to access digital DNA and learn more about social media, cyber crime and other internet based claims issues. Takeaways: Live hack experience re: social media to show scope of investigation. Speakers: Kadey Schultz, Managing Partner, Schultz Frost LLP | ||||

| 2018 CIP Society Symposium West - 'Challenge Everything: Transform the Norm' | 2018-08-23 | Cambridge | ||

Designed by insurance professionals for insurance professionals, CIP Society Symposium West is a full day of progressive learning aimed at increasing your skills and knowledge level. Now in its fourth year, the event provides a full day of professional and leadership development alongside multiple networking opportunities with insurance and business leaders. Symposium West is held for insurance professionals in the Southwestern Ontario, Hamilton/Niagara and Conestoga chapter areas. It brings together bright minds to give talks that a idea-focused and on a wide range of subjects, to foster learning, inspiration and wonder – and provoke conversations that matter. Kadey B.J. Schultz, along with Charles Gluckstein, presents "Autonomous Vehicles and Ethical Considerations": Autonomous vehicles are on the road. Within the next five years we should expect fleets to be taken over by AVs, first with a safety driver on board, then with no driver at all. In ten years, AVs will be regularly available to personal consumers. As an industry, are we ready and positioned for this seismic shift? From the way Ontario’s automobile legislation, regulations and policies are framed, to our adjusting, liability and litigation management, many changes need to be made. Later in the day, Kadey moderates the "Up Close and Personal: Senior Leadership Panel" with: Monica Kuzyk | Vice President Claims, Curo Claims Services Join us for the post conference Ice Cream Social and earn some RIBO credits while hearing from experts and industry leaders! Thursday, August 23, 2018, 8 am to 4 pm Ontario Mutual Insurance Assocation 350 Pinebush Road, Cambridge, ON N1T 1Z6

| ||||

| CDL Young Lawyers Conference | 2018-06-18 | Toronto | ||

Kadey Schultz joins a panel discussing practice managment for young (and old) defence lawyers. | ||||

| Music Heals 7! | 2018-06-13 | Toronto | ||

The 7th Annual Music Heals Fundraiser for the Biggar Endowment for Muscular Dystrophy at Holland Bloorview Kids Rehab Hospital.

Wednesday June 13, 2018 7:00 pm to Midnight

Adelaide Hall 250 Adelaide St. W. (Entrance at rear of Duncan St.)

Tickets are only $75 Donations and tickets are available here: www.hollandbloorview.ca/musicheals

| ||||

| Women in Insurance Conference - 'Getting to Your Why' | 2018-05-15 | Toronto | ||

Kadey Schultz is the Keynote Luncheon Speaker at the inaugural Women in Insurance Conference. Kadey's speech "Getting to Your Why: Maximizing Gifts and Talents in a 'Giving Back' Industry", explores why alignment and authenticity are critical to successful leadership and asks whether it is possible to master the balance between professional, community and family life. Be inspired and engage with today's women of influence & emerging leaders in insurance.

Vantage Venues 150 King St. W., Toronto

8:45 am - 4:00 pm

Get more information and buy tickets here: http://www.women.insurancebusiness.ca/event-details | ||||

| OIAA Mock Trial | 2018-04-11 | Richmond Hill | ||

The Annual OIAA April Meeting and Toronto Delegate Elections includes a mock trial and panel discussion with Schultz Frost LLP.

Sheraton Parkway Toronto North Hotel & Suites 600 Highway 7 East, Richmond Hill

12:00 to 4:00 pm

For more information, see the OIAA's website: https://www.oiaa.com/events/april-meeting-toronto-delegate-elections/

| ||||

| Law Society of Ontario Motor Vehicle Litigation Summit 2018 | 2018-03-27 | Toronto | ||

Kadey Schultz will be presenting an Accident Benefits Case Law Update on Day 2 of this year's Motor Vehicle Litigation Summit.

Law Society of Ontario Donald Lamont Learning Centre 130 Queen Street West, Toronto

8:30 am to 1:30 pm

For further information or to purchase tickets, please visit the Law Society of Ontario's website: https://store.lsuc.on.ca/motor-vehicle-litigation-summit-2018-day-two

| ||||

| Insurance Institute of Ontario - 'Fireside Chat' Breakfast | 2018-02-21 | Hamilton | ||

Kadey Schultz returns to moderate an exciting panel discussion with Brooke Hunter, Laurie Walker and Jason Arbuckle. Topics include: - Canada/US border issues; insurance crosses the border - Marijuana; agriculture, related distribution, pricing - Leadership; today's workplace - Cyber Wednesday, February 21, 2018 8:00 am to 10:30 am Michaelangelo's Banquet Hall, 1555 Upper Ottawa, Hamilton | ||||

| Cybersleuths - The Latest Insights in Investigation, Forensics and the Law | 2017-11-14 | Toronto | ||

Schultz Frost LLP and Reed Research are proud to present Cybersleuths: a day long conference for Insurance Adjusters, ADR Specialists, Claims Managers and other claims professionals who want to enhance their ability to access digital DNA and learn more about Cyber Risk, Cyber Crime and other internet based claims issues. Tuesday, November 14, 2017 10:00 am to 4:30 pm The Gardens Room Real Sports Bar and Grill 15 York Street, Toronto If you use social media and internet investigations as part of your claims handing and would like to attend the conference, please email Kadey Schultz at kschultz@schultzfrost.com for your free invitation and RSVP link. | ||||

| Crawford Canada Women's Leadership Lab | 2017-09-13 | Kitchener | ||

Kadey is delighted to be speaking at Crawford Canada’s Women’s Leadership Lab, discussing women in insurance, entrepreneurialism, momentum, diversity and disruptive philosophies, with a touch of humour and a ton of candour. Please reach out to Kadey at kschultz@schultzfrost.com for more information on this program and her leadership engagements. | ||||

| Music Heals 6! | 2017-05-24 | Toronto, ON | ||

A big thank to those who joined Schultz Frost LLP at the 6th Annual Music Heals Fundraiser this year. $43,000 was raised this year on the last night of the Hard Rock in Toronto! It has been 6 years since Kadey's son Emery was diagnosed with the terminal neuromuscular disease Duchenne Muscular Dystrophy. With your help all proceeds will go to the Biggar Endowment for Muscular Dystrophy at Holland Bloorview Kids Rehabilitation Hospital to help all the boys with DMD live their best lives – maybe even long lives. When: Where: Entertainment By: Your $75 admission includes a drink ticket and appetizers. There will be a silent auction table with great prizes. A tax receipt for $50 per ticket will be emailed to you once you complete your purchase. Tickets can be purchased on-line at www.hollandbloorview.ca/musicheals and a tax receipt will be emailed to you immediately.

To make a donation to the silent auction, please contact Joy at: jstothers@schultzfrost.com | ||||

| 2017 OIAA Provincial Conference | 2017-05-04 | Waterloo | ||

Join us in Waterloo on May 4, 5 & 6 for the 2017 OIAA Provincial Conference!

Kadey B. J. Schultz joins the SABS and LAT Panel Discussion - Is This What Anyone Expected? Moderated by OIAA Past President Catherine Groot, the panel will discuss the impact of the no fault changes and the currect state of Accident Benefits in Ontario. 9:15 am - 10:15 am on May 5, 2017

The Inn of Waterloo & Conference Centre 475 King Street North Waterloo, ON

| ||||

| CIAA Ontario Chapter - Things that Keep an Auto Adjuster up at Night: Sweet Dreams are just around the Corner | 2017-04-20 | Toronto | ||

Kadey B. J. Schultz leads a strategic discussion about the pressing adjusting issues that haunt our dreams and awake us in the middle of the night. Learn how to anticipate, prevent, de-escalate and strategize your way to 8 hours of uninterrupted ZZZs.

Thursday, April 20, 2017 from 9:00 am - 1:00 pm Sheraton Toronto Airport Hotel and Conference Centre Breakfast and Registration open at 8:30 am | ||||

| Advocates Society | 2017-04-07 | Toronto | ||

Kadey B.J. Schultz presents "License Appeal Tribunal Advocacy" The presentation and provocative discussion will cover:

Location: The Advocates’ Society Education Centre, 250 Yonge St., Suite 2700, Toronto, ON Seminar: 1:00 pm – 4:30 pm

| ||||

| Accident Benefits 2017 | 2017-02-24 | Toronto | ||

Kadey B.J. Schultz co-chairs "Accident Benefits 2017" Topics Include

Location: Osgoode Professional Development, 1 Dundas St. West, 26th Floor, Toronto ON Registration: 8:30 am Seminar: 9:00 pm – 4:45 pm

| ||||

| Successful Advocacy in Tort and Personal Injury Mediations | 2017-02-15 | Toronto, ON | ||

Kadey B.J. Schultz co-presents "Your Relationship with the Mediator" at the Osgoode Hall Successful Advocacy in Tort and Personal Injury Mediations The presentation and provocative discussion will cover:

Location: Osgoode Professional Development, 1 Dundas St. West, 26th Floor, Toronto, ON Seminar: 10:55 am - 11:35 am | ||||

| OIAA Trade Show and Conference | 2017-01-31 | Toronto | ||

Kadey B.J. Schultz presents "Accident Benefits, A Year in Review:There's no going back so let's make the most of the LAT"

Location: Metro Toronto Convention Centre, Constitution Hall, Room 201BD, Toronto, ON Seminar: 9:00 am - 10:00 am

| ||||

| The Ontario Insurance Adjusters Association Seminar | 2016-10-20 | Durham | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process.

Location: Deer Creek Golf, 2700 Audley Rd, Ajax Registration: 11:30 a.m. Lunch 12:00 pm Seminar: 12:30 p.m. – 3:30 p.m.

| ||||

| Canadian Defence Lawyers | 2016-10-06 | Toronto | ||

Join Kadey B.J. Schultz for her presentation on "Top 10 AB Cases of 2016" at CDL Accident Benefits Fall Classic.

Location: Hilton Toronto 145 Richmond Street West, Toronto, ON Registration: 8:30 am Seminar: 9:00 am to 4:00 pm Attendees will earn 5 - 6 hours of substantive CPD Credits | ||||

| The Ontario Insurance Adjusters Association Seminar | 2016-09-26 | Niagara-on-the-Lake | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process.

Location: Redstone Winery, 4245 King Street, Beamsville Seminar: 11:00 a.m. - 4:00 p.m.

| ||||

| The Ontario Insurance Adjusters Association Seminar | 2016-09-20 | Barrie | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process.

Location: Barrie Country Club, 635 St Vincent Street, Barrie Registration: 9:00 a.m. Seminar: 9:30 a.m. - 12:30 p.m.

| ||||

| The Ontario Insurance Adjusters Association Seminar | 2016-05-17 | Thunder Bay | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process. Date and Time: Tuesday, May 17, 2016 (1-4 pm) Location: DaVinci Centre, 340 Waterloo St S, Thunder Bay, ON P7E 6H9 Phone:(807) 623-2415 Broker attendees will earn 2.5 RIBO credits

| ||||

| The Ontario Insurance Adjusters Association Seminar | 2016-04-26 | Belleville | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process.

Location: Travelodge Hotel, 11 Bay Bridge Rd, Belleville, ON Registration: 9:00 am Seminar: 9:30 am - 12:30 pm

| ||||

| Canadian Independent Adjusters Association | 2016-04-21 | Toronto | ||

Join Kadey B.J. Schultz for her presentation on "Ontario Auto Reform: Much like the game of Blackjack, strategy is everything. Learn whether to Split, Double or Hit" at the April 21 Canadian Independent Adjusters Association event in Toronto. The 1/2 day event will also include a presentation by Keith Elliott of Reed Research, focusing on the Changing Environment of Insurance Investigation, using Social Media and Cyber Tools to your advantage.

Location: Sheraton Toronto Airport Hotel and Conference Centre, 801 Dixon Rd., Toronto, ON Breakfast and Registration: 8:30 am Seminar: 9:00 am - 1:00 pm

| ||||

| Hamilton Law Association/OIAA - Joint Insurance Seminar | 2016-04-19 | Hamilton | ||

Join Kadey Schultz and a talented group of presenters for this day long program which provides 5 substantive and 1.5 professionalism CPD hours. As part of the morning session, Kadey and Claire Wilkinson provide an overview of the regulatory changes to the Ontario no fault system and discuss the transition from FSCO/ADR to the Licence Appeals Tribunal (LAT). Location: The Hamilton Convention Centre, 1 Summers Lane, Hamilton Registration: 7:45 a.m. Seminar: 8:00 a.m. - 3:30 p.m. | ||||

| The Ontario Insurance Adjusters Association April Seminar | 2016-04-13 | Toronto | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process and provides 2.5 RIBO credits for RIBO licencees. Location: The Grand, 225 Jarvis Street, Toronto Registration: 12:30 p.m. Seminar: 1 - 4 p.m. | ||||

| 2016 WICC Ontario Gala Dinner | 2016-04-06 | Toronto | ||

Join us at the Gala Celebration of WICC's 20th Anniversary!

Founded in 1996, the Women In Insurance Cancer Crusade's mandate is to mobilize the Canadian Insurance Industry in the fight against cancer by focusing on cancer research, support and education. Over $11,000,000 has been raised to date for cancer research, with a focus on breast and prostate cancer. Schultz Frost LLP is honoured to have supported WICC over the years and we look forward to another successful Gala event with our friends and colleagues.

| ||||

| The Ontario Insurance Adjusters Association April Seminar | 2016-04-04 | London | ||

Kadey B.J. Schultz and Jason Frost present "You Can't Always Get What You Want, but if you try sometimes, you just might get... the LAT, new SABs and a working definition or two". The presentation and provocative discussion will cover: The substantive and procedural changes to the SABS June 1, 2016; The new LAT rules and how insurers from the adjusting level up can lead the transition from FSCO to the LAT; and The definition changes planned for catastrophic impairment, NEBs and the Minor Injury Guideline. This program is designed for adjusters, independent adjusters, examiners, ADR specialists, lawyers and all experts involved in the SABS process. Location: The Lamplighter Inn, 591 Wellington Road S., London Registration: 1:30 p.m. Seminar: 2 - 5 p.m. | ||||

| Dynamic Functional Solutions SABS Seminar 2016 | 2016-04-01 | Mississauga | ||

The "Dynamic SABS Seminar 2016" is a full day program designed for adjusters, insurers, medical practitioners and lawyers, with a strong focus on the amended definition of catastrophic impairment. Kadey B.J. Schultz will lead a lively and provocative discussion focusing on the legal and process issues at play with the new definition of catastrophic impairment: How many kicks at the CAT do we need to get it "right"? In the subsequent panel with Willie Handler and Dr. Michael Hanna, Kadey will discuss and debate all of the changes that will affect the accident benefits industry and the proactive management of SABS claims. Location: Mississauga Grand Banquet and Event Centre, 35 Brunel Road, Unit 7, Mississauga Agenda: 8:00 a.m.: Registration & Breakfast Register here: http://www.dynamicfunc.com/Registration.php

| ||||

| Ontario Insurance Institute (Hamilton) - Fireside Chat | 2016-02-25 | Hamilton | ||

Moderator: CEO Roundtable Location: Michaelangelo's Banquet Hall, 1555 Upper Ottawa Street, Hamilton Date and Time: February 25, 2016, 8:00 am to 10:30 am Kadey Schultz moderates a fireside chat with Donna Ince (Senior Vice President, RSA), Duane Sanders (President and CEO, Travelers Canada) and Ed Forbes (CEO, Dufferin Mutual) on hot insurance topics such as digital and direct distribution, technological changes (internet, autonomous vehicles) and the consumer-centric focus of insurance products.

| ||||

| Medico-Legal Society of Toronto - Kitty/CAT: The New and the Old | 2016-02-24 | Toronto | ||

Speaker: Kitty/CAT The New and the Old Location: 20 Toronto Street, Toronto Date: February 24, 2016 Join the Medico-Legal Society's 6th annual program on catastrophic impairment. Kadey Schultz presents the top 5 CAT cases and an expert panel, including Dr. William Gnam, Dr. Arthur Ameis and Dr. Bruce Paitich, provides their insight into the new catastrophic impairment definition. Register at: http://www.mlst.ca/?page=197 | ||||

| Osgoode PD: Accident Benefits 2016 | 2016-02-19 | Toronto, ON | ||

Kadey co-chairs this full-day professional development seminar devoted to the latest caselaw, legislative developments (the implementation of the LAT and SABS changes effective June 1, 2016) and practice tips for effectively presenting an accident benefits case on behalf of applicants or insurers. Register now at: osgoodepd.ca/accidentbenefits or click the below link. | ||||

| OIAA Claims Conference | 2016-02-03 | Toronto, ON | ||

Speaker: Accident Benefits: Just when you think you've got it... Location: Metro Toronto Convention Centre Date: Wednesday, February 3, 2016

| ||||

| OBA Institute: The Times They are a-Changin': The Impact of Societal and Technological Advancements on Insurance Law | 2016-02-02 | Toronto, ON | ||

Speaker: Cyber Risk in Canada: What to Watch Out for, and How to Be Prepared Location: 20 Toronto Street, 2nd Floor, Toronto Date: February 2, 2016, 8:45 am - 11:45 am The recent Ashley Madison data breach once more highlighted the fact that cyber losses are a very real threat for businesses and the demand for cyber risk insurance products has insurers looking at their potential coverage exposures for privacy risks and data loss. Hear about the emerging legal issues and get the information your need to properly advise your clients.

| ||||

| Osgoode PD: Succeeding on Mediations | 2015-10-29 | Toronto, ON | ||

Faculty: Succeeding on Mediations: A Toolbox for Advocates Location: Osgoode Professional Development, 1 Dundas Street West, 26th Floor, Toronto Date: October 29-30, 2015

| ||||

| 2015 RIMS Canada Conference | 2015-09-28 | Quebec City, QC | ||

2015 RIMS Canada Conference Session: 1B: Don't Let Them Eat Your Lunch - The Prevention Method… for Cyber Risk Palais des Congres de Quebec, Quebec City Date & time of session: Monday, September 28, 13:45-14:45 Session Coordinator: Kadey B.J. Schultz, LL.B., LL.M

| ||||

| OSOT Conference 2015 | 2015-09-26 | Kingston, ON | ||

Speaker: What's Trending in the Auto Insurance Sector Location: The Ambassador Hotel and Conference Centre, Kingston, ON Date and time: September 26th, 10:30 am

| ||||

| The Insurance Institute of Ontario | 2015-09-18 | Sudbury, ON | ||

Speaker: AB/BI - The Latest Trends, Legal Decisions & Best Practices Location: Days Inn, 117 Elm Street, Sudbury, ON, P3C 1T3 Date and Time: September 18, 2015 9:00 a.m. - 4:00 p.m. EST | ||||

Arbitrator Musson confirms an assault is an intervening event breaking the chain of causation between the use of the vehicle and the injuries suffered by the Applicant.